Tax Credits 2024 Electric Vehicles

Tax Credits 2024 Electric Vehicles. A $7,500 tax credit for electric vehicles has seen substantial changes in 2024. Up to $7,500 for buyers of qualified, new clean vehicles.

Those purchased in 2023 or later. According to tesla’s website, some buyers can qualify for the full $7,500 ev tax credit on the base model s, which is priced at $74,990 now, down from $104,990 on.

Those Purchased In 2023 Or Later.

The revamped 2024 ira program allows buyers to receive.

A $7,500 Tax Credit For Electric Vehicles Has Seen Substantial Changes In 2024.

As of 2024, any qualified buyer can transfer their clean vehicle tax.

It Should Be Easier To Get Because It's Now Available As An Instant Rebate At Dealerships, But Fewer Models Qualify.

Images References :

Source: thinkev-usa.com

Source: thinkev-usa.com

Electric Vehicle Tax Credits A Comprehensive Guide ThinkEVUSA, A $7,500 tax credit for electric vehicles has seen substantial changes in 2024. But new provisions in 2022’s inflation reduction act have made the ev tax credit easier to claim.

Source: newandroidcollections.blogspot.com

Source: newandroidcollections.blogspot.com

Government Electric Vehicle Tax Credit Electric Tax Credits Car, (link is external) , and those purchased in 2022 or earlier. Which cars qualify for a partial, $3,750 tax credit in 2024?

Source: www.theridgefieldpress.com

Source: www.theridgefieldpress.com

New Rules Which Electric Vehicles Qualify For The Federal Tax Credit?, The federal tax credit rules for electric vehicles often change, as they did on january 1,. Generally, you can either get a partial credit of $3,750 for a new electric vehicle purchase, the full $7,500 credit, a $4,000 for a used ev tax credit, or other qualifying vehicles.

Source: www.moveev.com

Source: www.moveev.com

Complete List of New Cars, Trucks & SUVs Qualifying For Federal, The federal tax credit rules for electric vehicles often change, as they did on january 1,. 1, 2024, consumers can transfer their clean vehicle credit of up to $7,500 and their previously owned clean vehicle credit of up to $4,000 directly to a car dealer, lowering a car's.

Source: evadoption.com

Source: evadoption.com

Fixing the Federal EV Tax Credit Flaws Redesigning the Vehicle Credit, (link is external) , and those purchased in 2022 or earlier. The irs put out its list of electric vehicles that still qualify for the full $7,500 tax credit, and it’s a lot shorter than last year.

Source: evadoption.com

Source: evadoption.com

Impact of Proposed Changes to the Federal EV Tax Credit Part 1, As of 2024, any qualified buyer can transfer their clean vehicle tax. (link is external) , and those purchased in 2022 or earlier.

Source: taxfoundation.org

Source: taxfoundation.org

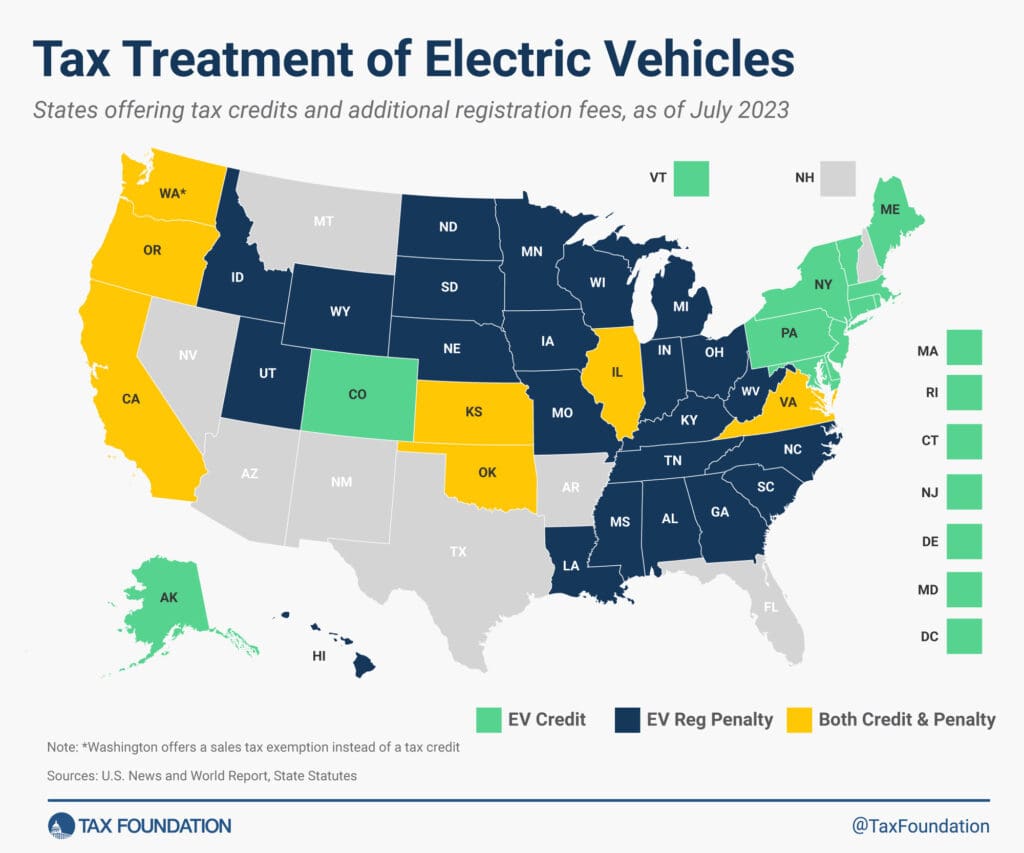

Electric Vehicles EV Taxes by State Details & Analysis, Today’s guidance marks a first step in the biden administration’s implementation of inflation reduction act tax credits to lower costs for families and. Which cars qualify for a partial, $3,750 tax credit in 2024?

Source: money.com

Source: money.com

2023 EV Tax Credit How to Save Money Buying an Electric Car Money, Which cars qualify for a partial, $3,750 tax credit in 2024? Of course, the 2024 blazer ev can also be had with a $7500 discount, because it's eligible for the full federal tax credit.

Source: vnexplorer.net

Source: vnexplorer.net

Tesla says all new Model 3s now qualify for full 7,500 tax credit, Up to $7,500 for buyers of qualified, new clean vehicles. As of 2024, any qualified buyer can transfer their clean vehicle tax.

Source: technoblender.com

Source: technoblender.com

Every electric vehicle that qualifies for federal tax credits in 2024, For this credit, there are two lists of qualified vehicles: Guide to instant savings for electric and hybrid vehicles.

The Irs Put Out Its List Of Electric Vehicles That Still Qualify For The Full $7,500 Tax Credit, And It’s A Lot Shorter Than Last Year.

This credit allows you to take a tax credit of 30% of the costs of “qualified alternative fuel vehicle refueling property” up to $1,000 for property placed in service on.

Guide To Instant Savings For Electric And Hybrid Vehicles.

Today’s guidance marks a first step in the biden administration’s implementation of inflation reduction act tax credits to lower costs for families and.